Surviving Semi/Unemployment: I Lived Off of My Credit Cards Because Spending an Emergency Fund is Actually Terrifying

/Today as Part 1 of a two-part series on “Creative Choices in Desperate Financial Situations,” (Read Part 2 Here!) I’m going to tell you guys about the time I was semi-employed and how I funded my life primarily with credit cards because the prospect of running out of cash is scary. And how I will not apologize for this. You also don’t need to apologize to anyone else for it, which brings me to a short story before I go into my own.

Paying the Minimum Payment and Hoarding Your Cash Is Smart, Not Reckless.

Last fall, a friend of a friend confided in me that she used her credit cards during a period of unemployment despite having a healthy emergency fund. We were discussing my blog and unconventional financial decisions when she shared this with me. She sounded embarrassed to admit that not only did she choose to do that, she didn’t regret it and felt it was the best choice she could have made.

She told me she was relieved to hear that I not only wasn’t judging her, I thought she’d made a great decision for herself and she didn’t need to justify it to me, of all people! Man, people are judgey about other peoples’ financial decisions. I love that because of my blog, people open up to me about their financial decisions, and I love even more that I can reassure people that there isn’t one “best way” to handle your finances.

Now look, I’m not one to recommend credit card debt for the heck of it, but when you’re in an uncertain employment situation, maintaining the ability to pay for the basics without depleting your entire savings account might be preferable to watching your savings account dwindle to nothing while you’re looking for a job. If you’ve never been threre, it’s hard to understand the desperation you feel when you know your money will be running out soon if something doesn’t give.

Let me also be clear that you shouldn’t use credit cards to live above your means on a regular basis. I’m talking about unemployment. This is a financial crisis situation, not everyday life.

Eventually, I found myself in a semi-employed situation, and my expenses were outpacing my income by a large amount. I started hoarding my cash and paying for everything on my credit cards. Something about having a cash cushion was comforting to me.

The anxiety I’d have if I suddenly couldn’t cover my rent with my savings is entirely different than the anxiety of having a few credit cards to pay off once I get a new job (plus, ideally, I’d have the cash I’d been hoarding to use for that once I’m employed).

Minimum payments deplete cash reserves a LOT slower than paying your expenses with your emergency fund. Unless you have like, a year, of emergency fund money (which let’s be honest, most do not…) or you have some other huge cash or semi-liquid asset reserve, keeping cash available is one of the most important things you can do when your employment situation is borderline- or actually nonexistent.

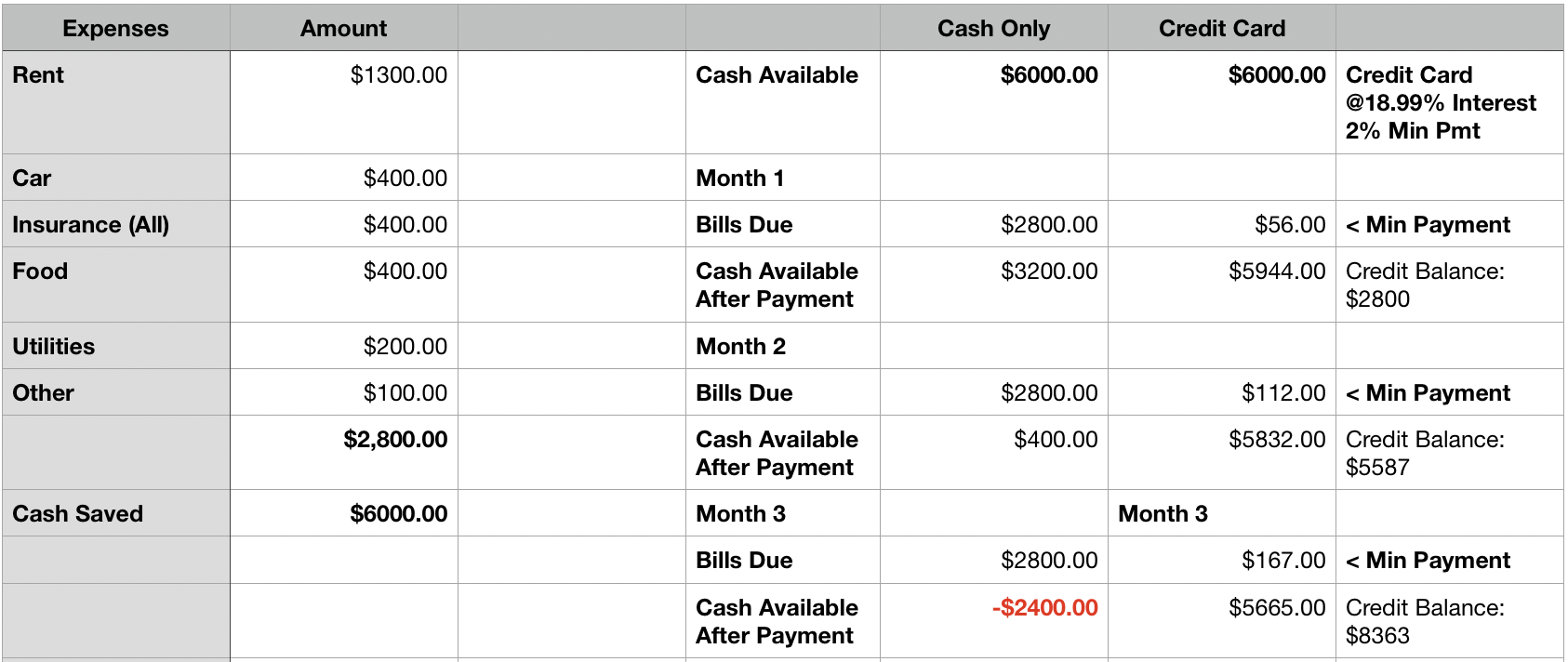

Let’s look at how long a $6,000 emergency fund would have lasted with me paying cash vs. how long it would last with me paying minimum payments on my credit cards:

I simplified a lot in the budget and assumed an average interest rate. i’ll talk about how to get that rate down in the sections below but wanted to show what it would look like even with a higher rate. for simplicity i’m also leaving out any income from side gigs.

If I’d used my cash reserves, I would have been out of money in fewer than THREE MONTHS! That’s scary. Using my credit cards gave me peace of mind that I wasn’t going to miss a bill payment or lose my apartment or my car. Missed payments, evictions and repossessions are WAY worse for your financial future than a high utilization rate on your credit cards for a few months.

I know using credit cards will cost you money. And this may not be the solution for everyone, but it worked for me, and you shouldn’t feel ashamed if you’re facing some kind of paycheck interruption and you don’t want to (or can’t) rely on your emergency fund for any meaningful length of time. Do what you have to do to stay afloat.

A Few Months of Credit Card Interest is a Small Price to Pay to Maintain the Peace of Mind of Keeping Your Cash Reserves Intact.

There’s a backstory to the story in this post, which one day I will tell in full, but suffice it to say that I left a horrendously miserable job (not really my choice at the time, but I had already been looking to leave for months) and began a cross-state job search in earnest. I accepted a medium-term contract attorney position at a company going through a bankruptcy and high-tailed it out of my firm before my clock there expired.

Related Posts: I Dreamed I Got Fired And Now I’m Fired-Proofing My Finances | An Incomplete List of My Money Regrets & How Much They Cost Me | Job Search (& Survival) Tips: Figure Out the Bad You Can Live With

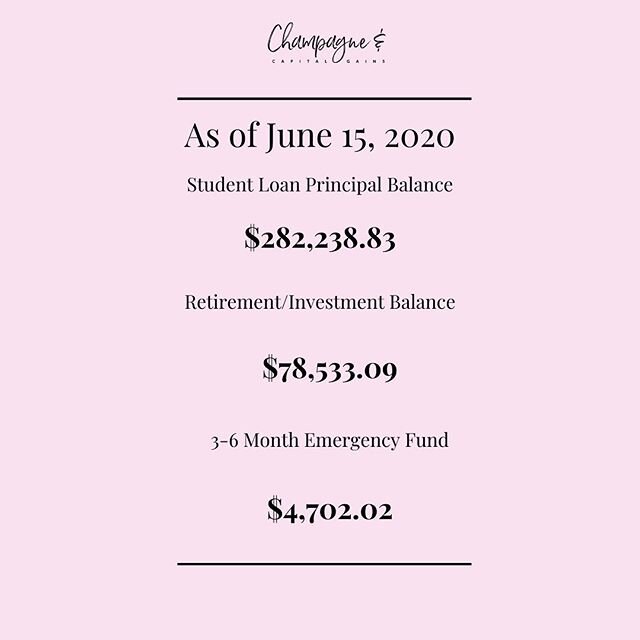

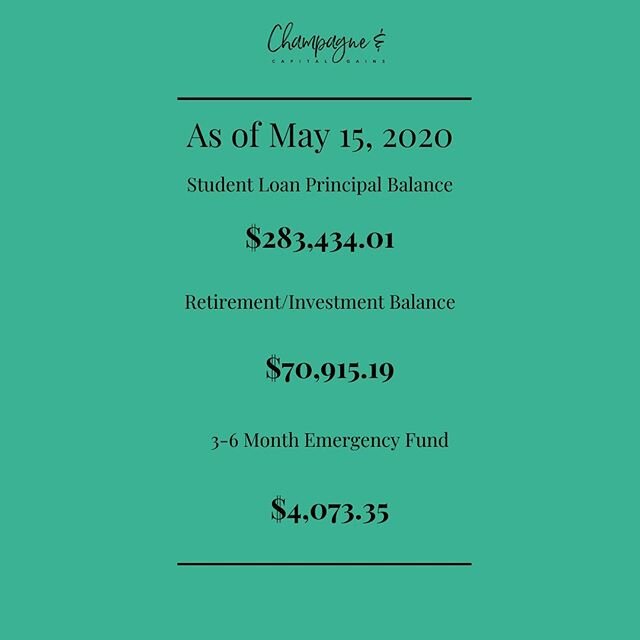

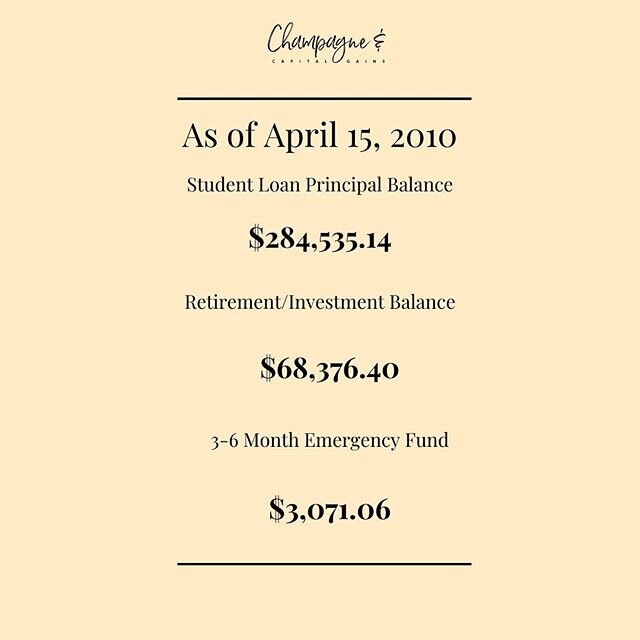

I relocated without a full-time job lined up. I was doing some contract work, but it had slowed to a trickle by the time I moved. My bank account had about $6,000 in it, which was 2-3 months of expenses (my student loans were in deferment, fortunately…but that means I was negatively amortized which is HORRIBLE).

I rented my apartment using my contracted hourly rate as my salary. I took up babysitting in the fancy part of town to help with cashflow ($20/hour…don’t sleep on babysitting wealthy kids for extra money!)

And I put EVERYTHING I COULD on my credit cards. I even paid rent on my credit cards (that 3% fee? Worth it.) The only cash outlays I had each month were my (admittedly rising) minimum credit card payments, my car payment and any bills that had to be paid in cash.

Being Single with no Family Backup Makes Semi/Unemployment a Very Different Ballgame

When you have an income-earning partner and you lose one of those incomes, that’s going to hurt, but it’s not going to be an all-out income drought. It might be hard to make ends meet (or impossible, depending on the remaining income vs. expenses), but you still have actual new money landing in your bank account every month.

For single people, losing their income is completely different. Unless they have parents or other people who are willing and able to help them financially, there’s no one else earning for the household in absence of their paycheck. That can be devastating. Even with an emergency fund, there aren’t other options for surviving unemployment long term other than becoming employed. Period.

My parents are wonderful, and they have helped me in many ways that have saved me a lot of money (driving across the country to help me move AT LEAST 3 times is a notable example), but they couldn’t lend me even a month’s worth of money to pay my bills and they live a day’s drive away. I don’t have family nearby I could live with.

I do have friends who have said they wouldn’t let me become homeless, but having a couch to sleep on is not the same as having money to pay your car payment (and if you get to the point that you’ve been evicted, your money problems are big and won’t be easy to fix, because you’ll have to repair not only your financial situation but also your reputation of creditworthiness).

Being single and semi- or unemployed requires more strategic behaviors with respect to money management. For me, that was maintaining my cash reserves at any cost. If you’re in a similar situation and the prospect of running out of cash terrifies you, do what I did.

Missed payments, evictions and repossessions are WAY worse for your financial future than a high utilization rate on your credit cards for a few months.

All-out credit aversion is one of my biggest issues with the Dave Ramsey method, especially for people with a lot of non-mortgage debt that will take years to repay. A $1,000 emergency fund is NOTHING (ok, it’s not nothing and if you have worked hard to get to that point, that’s a great accomplishment! But in terms of paying for life during unemployment, it is not enough).

Combine a tiny emergency fund with LITERALLY CUTTING UP CREDIT CARDS and telling people to cancel their accounts, and you’re up the proverbial creek without a paddle if you are single, you lose your source of income, AND you’ve voluntarily forfeited a line of credit that could help you float a few months of expenses while you’re looking for a new job.

Moral of the story: Don’t cut up your credit cards. They are a valuable emergency tool if you have them, particularly if you’re single.

Limit the Financial Impact of Credit Card Usage and Improve Your Cashflow During Unemployment

Check for promotional rates on your existing cards or request a lower interest rate if none are offered, apply for a 0% interest card, and/or request a credit limit increase. I’m going to talk more about this in my next post so I won’t go into a ton of detail, but you should definitely try to reduce the amount of interest you’re paying on your credit card balances if you’re adding significantly to that balance each month you’re unemployed. Also, reduce your expenses because duh. Don’t spend ANY money you don’t have to.

Play It Cool

With people you don’t know or creditors, it behooves you to act like nothing is wrong insofar as that is possible. If you have a temporary paycheck interruption or you’re trying to find a new job, ask for the financial things you need without indicating that you’re backed into a corner.

It may sound strange, but acting like there’s nothing for a creditor to worry about makes it more likely for the creditors to help you in a way that gives them nothing to worry about. Extending your credit line, reducing your interest rate, etc. - costs you less and therefore improves your ability to meet all your financial obligations during your time of financial stress.

Hustle, but Not So Much You Can’t Apply for Jobs

This was an important part of my credit card living: I immediately listed myself on babysitting/nanny websites to improve my cash position.

This is very important: WORK A GIG. I don’t care what it is, but make it happen. Immediate cashflow is super important. And choose higher-earning options if they’re available. I only applied to or responded to babysitting jobs in the nicest neighborhoods in town that were going to pay $15/hour or more. If you’re able to be discriminating with your gigs, you absolutely should.

Try to work these gig-type job(s) that will keep you less in the red while also giving you enough flexibility to search for a new job and take interviews if you need to. Even with my credit cards-instead-of-cash plan, I was nearing the end of my $6,000 reserves when I finally landed a full-time job. I was nearing the time to apply for something less flexible, like a retail sales associate position, bartender, or similar job that I could have done well with the skills I already had. You may get to that point, but using the credit cards will significantly delay that timeframe.

This hustling advice is most applicable to people living in larger cities who have lost employment from white- or blue-collar salaried positions. If you live in a lower-populated area or lost a retail, bartender or other service-industry job and cannot find another one, this advice obviously won’t be as helpful for you.

Apply for unemployment ASAP if you’re fully unemployed

This is pretty self-explanatory. If you lose your job, you should apply for unemployment immediately. Sometimes there are time limits and minimum waiting periods required for you to begin receiving unemployment benefits, so you want to get to this as quickly as you can. You may not be eligible for much, but it will help offset costs (obviously).

Make sure your hustling money doesn’t keep you from earning unemployment benefits - earning both would be ideal, but choose the higher-paying one if you can’t have both.

So, to review:

Peace of mind is most important. If keeping a cash reserve helps you do that, this is a great plan

Being single and/or having no backup financial help limits your options during semi/unemployment and you should do what you need to do to ensure you’re able to stay afloat as long as possible

You should take steps to limit the damage of credit card use and also improve your cashflow during semi-employment

If you do all of these things in conjunction with mostly using your credit cards for your bills, you’ll significantly prolong the length of time between losing your job and total financial panic. And not losing your apartment or car is worth a few hundred dollars of credit card interest.

Part II will be The Time I Bought Amex Gift Cards with My Target Card: Desperate Money Hacks to Avoid Payday Lenders or Missing a Payment

Have any of you ever lived on credit cards during unemployment instead of using your emergency funds? Why did you make that decision and how do you feel about it now?