May 2018 Extra Debt/Loan Payment Report

/Hey folks! Happy week after Memorial Day - to those of you who have lost family members, friends, or fellow servicemembers, I join you in remembering their sacrifice and yours. I hope everyone had some productivity AND fun over the long weekend.

If I may, I’d like to share this song by MY ABSOLUTE FAVORITE ARTIST EVER, Jason Isbell, as a Memorial Day Tribute before we get started (the video quality isn't great, but the sound is fine and I couldn't get Spotify's link to work...#newbloggerproblems):

Now for the main event: extra debt payments!

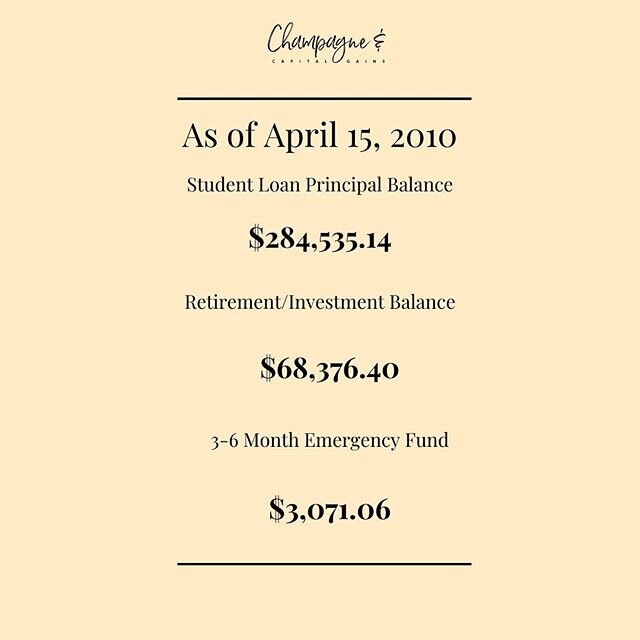

So I haven’t discussed my debt very much on the blog yet. I mentioned it in my Intro Posts and haven’t really touched it since (ok, that’s technically not true, as I’ve been making debt payments ALL THE TIME it feels like...but I haven’t blogged about it!). I have a lot of student loan debt. A lot. Like low-mid 6-figures. Plus my car loan, and a couple of 0% interest credit cards to which I’ve moved portions of loans. I’ve also been cashflowing a ton of expenses recently, and I’m going to be honest: I need to get a more specific budget going in my life because otherwise, things may get #outofhand.

Ms. C&CG's Debt Load

But for now, let’s focus on my actual loans, not the 0% credit cards, as those aren’t accruing interest. I have a LARGE student loan (CommonBond, $200k+ at 5.20% variable interest rate), a small student loan (Navient, $22,964.14 at time of writing, 5.16% fixed interest rate), and my car loan (~$35,000, 3.59% fixed interest rate).

If you’re wondering “Wow, how did she end up with SO MUCH STUDENT DEBT?” please check out my financial mistakes post and feel better about your own life decisions. I missed a lot of financial opportunities in my youth. And so here we are. Y'all, our student loan officer in law school would cheerily tell us each semester "oh well, it's just another drop in the bucket!" In retrospect, we should have tarred and feathered her or something...I’ll probably write on my student loans and financing choices at some point as well.

As for the car, this will be the last car I finance. It’s a long story, but suffice it to say I minimized the cost of the car, got exactly what I wanted, will drive it for a long time, and my income supports it, so I have no regrets. Not every purchase you make has to be *The* Best Financial Decision Ever (but unless you have a 6-figure salary and/or no debt, I highly recommend against cars that cost in the $25k+ range).

Ms. C&CG's Sidehustles

I don’t have a major sidehustle at the moment - mostly selling extra clothes on Poshmark and casually selling face products (don’t worry, I’m not coming after you with my MLM. I’m in it for the discount on products I’m obsessed with and already used, plus any ancillary sales from interested friends…), and a good chunk of my extra payments came from these half-assed side hustle efforts.

That said, I actually had enough other random, stealthy money available to make quite a few extra payments in the past month, so I was able to make a larger-than-usual dent in the principal of my smaller student loan. Very exciting! Here's the breakdown:

Ms. C&CG's Extra Debt Payments List

Extra Payment: $150 | Source: CommonBond refinance bonus I’d forgotten was in my PayPal account | Recipient: Navient (Small) Student Loan

This was very exciting, y’all! I actually discovered that I hadn’t transferred this bonus to my checking account when I logged into PayPal to transfer money for my Fincon ticket. I did actually allocate an extra $150 to my investments after my refinance, so technically the money had been spent, but I took it as an opportunity to pay a little bit more on my loans. CommonBond was a very easy company to work with on student loans, so if you’re looking to refi, feel free to check it out with my referral link! The company is great because you can refinance any amount of loan (at least with a professional degree) and they had great interest rates. The process was also super simple. (This isn’t sponsored content, I just enjoyed them so much after a nightmare of trying to deal with SoFi that I want to tell you all about them. I'm about to re-refinance though, so I'll let you know who I use.)

Extra Payment: $185 | Source: UPromise Cashback Redemption | Recipient: Navient (Small) Student Loan

UPromise is a cashback shopping site that offers all kinds of services - from basic cashback earning through their portal (P.S. you can use any credit card so HELLO STACKING REWARDS), to 529 funds and savings accounts for your children. When you want to cash out, you can technically use the money for anything, but I stuck to its intent to repay student loan balances. This money accumulated over a few years, but I haven’t used the site religiously. Since this redemption, I’ve already earned another $16.32. I plan to start using the site and cashing out more frequently, as money sitting around doesn’t do very much for me. I’ll also probably do a full UPromise review at some point because it’s pretty cool.

Look at all the neat things you can do on UPromise! I type stores in the search bar before online shopping to see if they offer cash back.

Extra Payment: $37.09 | Source: Discover Cashback Bonus | Recipient: Discover Credit Card Balance

I had a lot of Cashback Bonus I hadn’t used, so I finally decided to use it all at once. Again, money doesn’t do any good sitting there, right? I usually try to buy gift cards to maximize the earnings, since gift cards always cost at least $5 less than their value through the Discover Cashback redemption portal. I first redeemed $100 of cashback for $150 to Sunglass Hut and I redeemed $80 for $100 to Athleta (needed new Ray-Bans and workout gear!). The remainder, $37.09, went to my bill. This is one of the cards I’ve been using to cashflow purchases, so I needed to pay as much as possible quickly. Overall I felt pretty good about the allocation. And now look at all the Cashback I have for next month:

Discover keeps a display panel of your current cash back earnings & adds your previous statement's earnings with each new statement. It's one of my favorite credit cards. And look at those bonus categories!

Extra Payment: $42.10 | Source: Poshmark Redemption | Recipient: Discover Credit Card Balance

I sold $69.15 last month on Poshmark, which I broke into multiple payments as the sales cleared. This was actually a pretty large sales month for me, and I’m sad to say the last two weeks have been sale-less. Bummer. I paid more on the Discover Card, because again, it’s housing most of my cashflow balance and I want to pay it before the interest starts accruing.

Extra Payment: $94.30 | Source: Poshmark Redemption; Skincare Company Payment/Commission | Recipient: Discover Credit Card Balance

This payment was $24 of additional Poshmark sales and $71.30 of product commission and general sales commission from the skincare company I mentioned above. For reference, I sold about $300 of skincare products last month. Not terrible for doing basically no work! More money to the Discover card. Again, I'm not paying interest at the moment, but I want to make sure it gets paid off from cashflow so it doesn’t start to accrue later.

6. Extra Payment: $3.05 | Source: Poshmark Redemption | Recipient: American Express

This was my final Poshmark cashout for the month, and because it was so small, I just added it to an Amex payment I was making to reimburse myself for a group of tickets I bought to a show with friends. I figured that was easier than making a completely separate payment to an actual loan. So functionally my own ticket was $3.05 off.

Total Payments from Extra Income May 2018: $512.54

An extra $500 of payments, mostly to debt, this month! I’m proud of myself for making a significant dent in my Small Student Loan in particular. It’s in the $22ks now (down from a high of ~$24k in September) and I want to start tackling that loan ASAP once all my insane cashflowing needs subside. As an added bonus, I was able to make money while both ridding myself of 6 or 7 pieces of clothing and giving them extra life with a new owner! Although it’s slower going to sell clothes, I’m passionate about doing that rather than giving them to charities of questionable environmental and social responsibility.

I probably won’t have another month like this for awhile, but after such a successful May, I’m now even more motivated to find/make extra cash to throw at debt this summer.

Did you guys find ways to make extra payments this month, either through cashback on things you were already going to buy or sidehustling? What new ideas are you going to try? I’d love to hear in the comments!